Since most new traders blow out their first account anyway, this is also a lot of money to put at risk. If you like the thrill of digging through a ton of stocks to find a few hidden gems, then stock trading may be easier for you. One of the reasons that the success rate with small trading accounts is so low in most markets, is because the minimum lot size is huge, relative to these small accounts.

Business News Live: Stock Market Closes In Green; Sensex Up 333 Points, Nifty At 19,820 – ABP Live

Business News Live: Stock Market Closes In Green; Sensex Up 333 Points, Nifty At 19,820.

Posted: Fri, 08 Sep 2023 13:44:40 GMT [source]

It is important to check stock prices over a long period of time compared to a short period of time. You will see that often the growth in the short term is negative, but is positive over a long period of time. The stock market may be the simplest option to understand when compared to forex and futures. With forex, you can start simply by focusing on one currency pair at a time.

Forex vs stocks

Volume in the case of both markets is the amount traded in a given period of time (usually one day). Macro and microeconomic factors are also taken into consideration (as well as many other factors), and used to determine a company’s potential or future value. Those who are interested in business and long-term investors may find that the stock market is more suitable for them. By examining past data, traders are sometimes able to identify highs and lows, so that they can buy and sell at the best times to make the most amount of profit. Stock trading offers global shares like blue-chip stocks and penny stocks and in a myriad of industries from technology to automobile and more. Banks, hedge funds, governments, retail currency conversion houses, and large net worth individuals are just some of the participants in the spot currency markets where the liquidity is unprecedented.

New traders can have a tendency to use too much leverage and blow out their accounts. If you don’t understand how to control risk, then higher leverage is dangerous. In the stock market, the PDT Rule limits small account traders from making more than 4 intraday trades, within a 5-day period.

Comparing Market Accessibility of Forex and Stocks

The forex market has about $6.6 trillion in average traded value each day, making it the largest financial market in the world. However, there are a greater variety of assets to trade in the global stock market. Brokers may offer dozens of currency pairs, but there are thousands of stocks. Exchange rates forex trading vs stock trading in major currency pairs rarely change more than 1% during a day. In stock trading, investors aim to profit from the appreciation of stock prices or dividends paid by the company. They can buy shares of individual companies or invest in exchange-traded funds (ETFs) that represent a basket of stocks.

ICYMI – Nvidia CEO Jensen Huang sells $42 mn in shares (but its OK) – ForexLive

ICYMI – Nvidia CEO Jensen Huang sells $42 mn in shares (but its OK).

Posted: Fri, 08 Sep 2023 03:00:00 GMT [source]

Understanding the differences between forex trading and stock trading is essential for traders and investors to choose the option that aligns with their goals, risk tolerance, and trading preferences. Both markets offer opportunities for profit, but they require knowledge, skill, and careful risk management to succeed. Forex trading and stock trading are two distinct investment options, each with its own set of characteristics and advantages. Forex trading provides access to the largest and most liquid financial market, offering high liquidity and the opportunity to trade currency pairs from around the world. Stock trading, on the other hand, allows investors to participate in the ownership of publicly traded companies, benefiting from the company’s success through stock appreciation and dividends. The forex market is great for day traders, swing traders, and scalp traders who use fast-paced markets with adequate volatility to their advantage.

Investing in stocks

Despite being interconnected, the forex and stock market are vastly different. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. In order to claim MTM status, the IRS expects trading to be the individual’s primary business.

The best time of day to trade forex is when the market is the most active, which is usually when two sessions overlap, as there will be a higher number of buyers and sellers. For example, if you were interested in GBP/USD, London and New York trading hours overlap between 12pm to 4pm (London time). The increased liquidity will speed up transactions and even lower the cost of spreads. As forex is a completely global market, you can trade 24 hours a day, five days a week. This provides you with ample opportunities for trading, but also creates the risk of the market moving while you aren’t around to monitor it.

What Are the Differences Between Forex and Stock Trading?

When investing in shares, you could traditionally only take a long position, as you’d be looking to profit from any future increase in the value of a company’s stock. But thanks to derivative products, such as CFDs, you can go long and short on company shares – giving you equal access to trading opportunities whatever the future direction of the market. Another factor to consider before trading forex or shares is what moves market prices. Primarily, both markets are influenced by supply and demand, but there are a host of other factors that can move prices.

Trading forex comes with a variety of benefits such as lower fees, flexible hours, and higher trading volumes compared to stock trading. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Correlation between the forex and stock markets

Like forex, then, futures traders have the ability to trade in large position sizes with a small investment, creating the opportunity to enjoy huge gains—or suffer devastating losses. Stock index e-mini futures are other popular instruments based on the underlying indexes. The e-minis boast strong liquidity https://g-markets.net/ and have become favorites among short-term traders because of favorable average daily price ranges. The e-minis, including the e-mini S&P 500, the e-mini Nasdaq 100, the e-mini Russell 2000, and the mini-sized Dow Futures are traded around the clock on all-electronic, transparent networks.

- While broader economic context always helps, buying a stock is a simple concept—you’re buying a share of ownership in a company.

- There is a difference between privately owned stocks and publicly traded stocks.

- Below you will see the spread of the EUR/USD highlighted inside of the executable dealing rates.

- Regardless of which option you choose, study and develop a strategy before you begin to invest.

Leveraged products, such as spot forex, can be used to trade on margin across a range of markets. When deciding between forex and the stock market, it is important to identify all the opportunities available to you – notably, can you short sell? The ability to short a market opens you up to a whole new dimension of market movements, enabling you to speculate on both rising and falling markets. Forex is the largest and most popular financial market in the world, which means it is extremely liquid and frequently sees a daily turnover of trillions of dollars. Currency prices are influenced by an enormous number of factors, to the point where the market can seem to move at random.

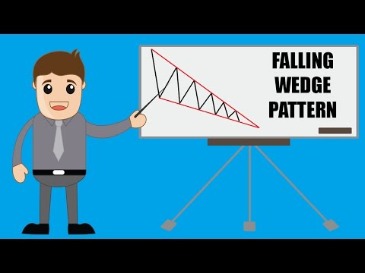

Technical Analysis

If you have limited capital to start day trading, then forex might be best for you. The forex market is also flexible in that you can trade outside of U.S. market hours, which helps if you have another job during regular U.S. business hours Monday through Friday. Most futures day traders focus on opportunities in one futures contract type after gaining proficiency at trading it. That said, there are day traders who prefer to trade where the action is, choosing futures contracts that are seeing big movements or volume on a particular day. Currencies simply like to trend, as they’re influenced by a number of fundamental factors that gradually build up over time leading to strong trends in the long-term.